- Analytics

- Technical Analysis

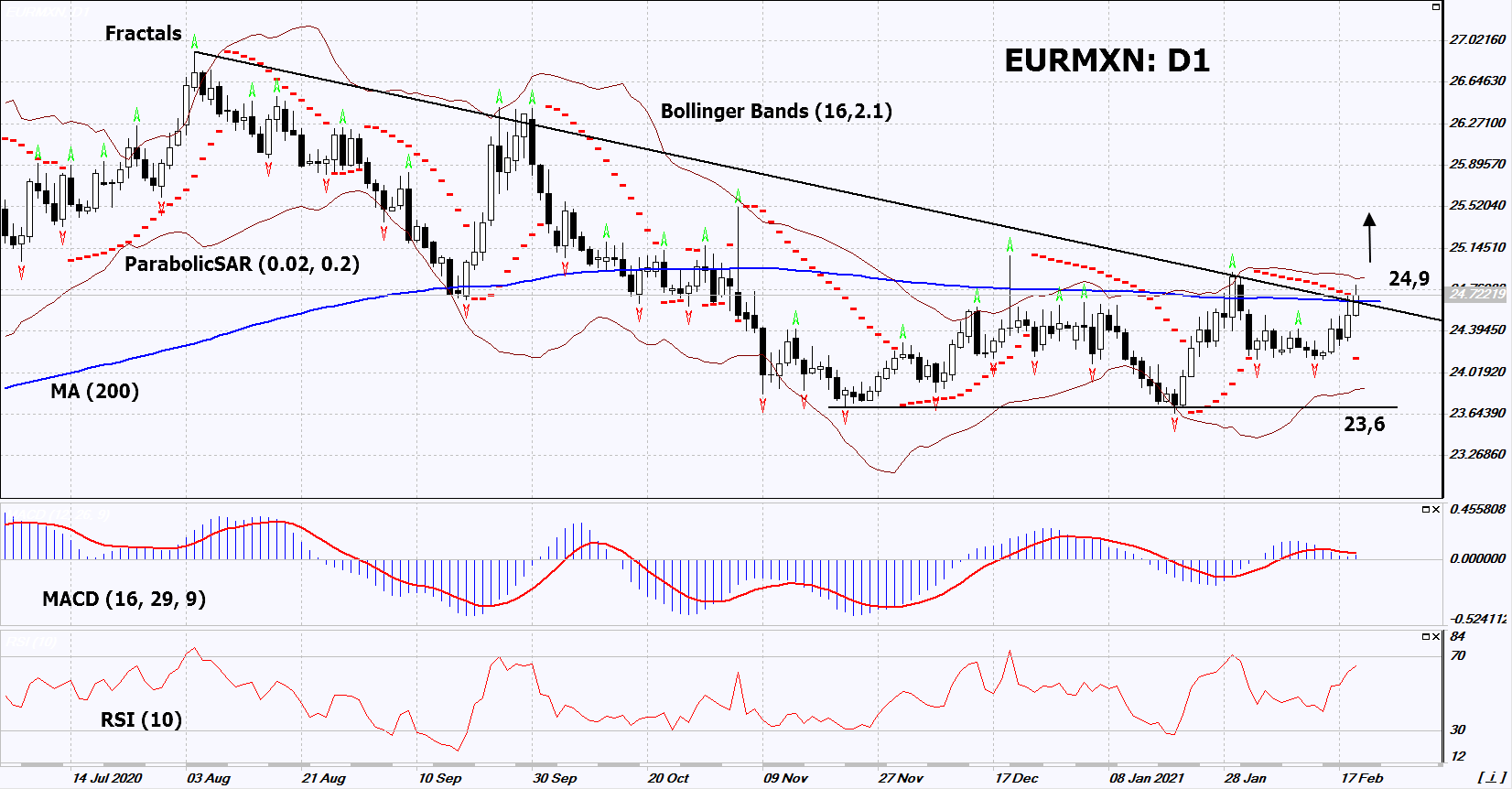

EUR MXN Technical Analysis - EUR MXN Trading: 2021-02-22

EUR/MXN Technical Analysis Summary

Above 24,9

Buy Stop

Below 23,6

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Neutral |

| MA(200) | Neutral |

| Fractals | Neutral |

| Parabolic SAR | Buy |

| Bollinger Bands | Neutral |

EUR/MXN Chart Analysis

EUR/MXN Technical Analysis

On the daily timeframe, EURMXN: D1 formed the double bottom pattern and exited the downtrend. A number of technical analysis indicators formed signals for further growth. We do not rule out a bullish movement if EURMXN: D1 rises above the upper Bollinger band: 24.9. This level can be used as an entry point. We can place a stop loss below the Parabolic signal, the lower Bollinger band, and a 12-month low: 23.6. After opening a pending order, we can move the stop loss to the next fractal low following the Bollinger and Parabolic signals. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the four-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (23.6) without activating the order (24.9), it is recommended to delete the order: the market sustained internal changes that have not been taken into account.

Fundamental Analysis of Forex - EUR/MXN

The Bank of Mexico may cut the rate twice this year. Will the EURMXN quotes grow?

An upward movement signifies the strengthening of the euro and the weakening of the Mexican peso. Gerardo Esquivel, Deputy Governor of the Bank of Mexico, announced his office could cut the rate twice in 2021. Recall that now it is 4%, the lowest since May 2016. This is higher than the Mexican annual inflation in January (3.54%). In 2014-2015, the Bank of Mexico rate was 3%. This Wednesday and Thursday (February 24-25), Mexico is due to release important data on inflation, retail sales, GDP, and the labor market, which may affect the exchange rate of the peso. The euro strengthened last week thanks to the positive ZEW Economic Sentiment and the Markit Manufacturing PMI in February. Moreover, the change in the Eurozone GDP in the 4th quarter was slightly improved in the 2nd outlook (from -0.7% to -0.6%). Recall that on February 25, the EU leaders' summit will be held. The speeches by ECB representatives are expected to affect the euro dynamics.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.