- Education

- Canadian Stocks List

- BCE Inc Stock

BCE Inc Stock Price and Overview

Looking to explore bce inc stock?

You are in the right place. Let’s start!

BCE Inc., a household name and the country's leading communications provider, might have caught your eye. It’s crucial to understand the company's strengths and weaknesses, along with market trends. So in this article we will provide a concise overview of BCE Inc stock, covering key points like its current price, trading details, and overall outlook.

KEY TAKEAWAYS

- BCE has raised its dividend every year for 15 years, making it a good choice for investors who want regular income from their investments.

- The telecommunications industry is generally less prone to big swings in price than other sectors, which can help reduce the risk of your overall investment portfolio.

- BCE is the largest telecom company in Canada, but it faces competition from other major players like Rogers and Telus.

- BCE has a history of growing through strategic acquisitions, which could help it continue to expand in the future.

About the BCE Inc Stock

BCE, formerly known as Bell Canada Enterprises, is a major player in the Canadian communications industry. It's like a one-stop shop for various services, offering phone, internet, TV, and media through its subsidiaries like Bell Canada and Bell Aliant across the country. You can find them traded on the Toronto Stock Exchange under the symbol "BCE".

Here's a breakdown of their situation

- Market value: As of February 7th, 2024, BCE is worth around CA$48.41 billion.

- Current BCE stock quote: Each share costs CA$53.07 (as of February 7th, 2024). It's fluctuated between CA$49.57 and CA$65.66 in the past year.

- Dividends: They pay out a good portion of their profits as dividends, currently offering a 7.24% return.

- Highest price in the past year: CA$65.66.

- Lowest price in the past year: CA$49.57.

Good things about BCE:

- Been around for a while and does well: Pays out increasing dividends regularly, indicating financial stability.

- Offers a variety of services: Not dependent on just one area of the communication market.

- Canadian market potential: Well-positioned to grow as Canada's communication needs increase.

Things to consider before buying:

- Share price might be high: Compared to its past value, the price might be a bit expensive.

- Competition: Other companies like Rogers and Telus could affect BCE's business.

- Government rules: Changes in government regulations could impact BCE's operations.

BCE Inc Share Price

Let’s explore BCE historical stock price for last year to gain a better understanding, where the company stands.

As you can see, the BCE Inc. share price fluctuated throughout the year, with a high of $65.66 in November 2023 and a low of $49.57 in February 2023. The share price ended the year at $53.07, which is a gain of 7.24% from the beginning of the year.

Here are some of the factors that contributed to the fluctuations in the share price of BCE Inc. last year:

- The overall performance of the Canadian stock market: The Canadian stock market had a volatile year in 2023, with the S&P/TSX Composite Index falling by 9.2%. This decline had a negative impact on the share price of BCE Inc.

- The performance of the telecommunications sector: The telecommunications sector also had a volatile year in 2023, with the S&P/TSX Telecommunications Index falling by 6.2%. However, BCE Inc. outperformed the sector, as its share price gained 7.24%.

- Company-specific factors: There were a number of company-specific factors that impacted the BCE Inc. share price last year, such as the launch of its new 5G network, the acquisition of several small wireless providers, and the announcement of a dividend increase.

Overall, the share price of BCE Inc. had a mixed year in 2023. The share price was up 7.24% for the year, but it did fluctuate significantly throughout the year.

BCE Inc Stock Trading

Here are a few steps that you need to go through if you want to trade or invest successfully:

1. Open a Brokerage Account

Choose a reputable online broker based on fees, features, and user experience. Ensure they offer trading in Canadian securities.

2. Fund Your Account

Transfer funds from your bank account to your brokerage account to facilitate buying shares.

3. Research and Analyze

Before investing, meticulously research BCE Inc. and the entire telecommunications industry. Consider:

- Review earnings reports, debt levels, and growth potential.

- Analyze market competition, regulatory landscape, and technological advancements.

- Utilize charts and indicators to identify potential entry and exit points.

4. Develop a Trading Plan

Define your investment goals (short-term vs. long-term), risk tolerance, and budget. Establish entry and exit strategies based on your research and risk appetite.

5. Place Your Trade

Choose an order type that aligns with your strategy (e.g., market order for immediate execution, limit order for specific price execution). Be mindful of fees associated with each order type.

6. Monitor and Manage Your Position

Continuously monitor BCE's performance and industry developments. Adjust your plan as needed, adhering to your stop-loss limits to manage risk.

Note: trade during regular Canadian stock market hours (9:30 AM to 4:00 PM Eastern Time).

BCE Inc. stock Technical Analysis

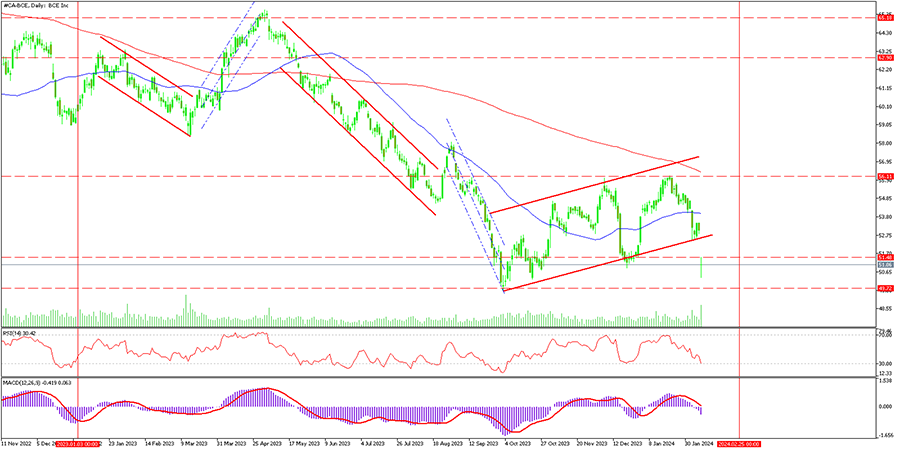

Overall technical analysis suggests that BCE stock is in a downtrend, but there have been some periods of upward movement. The technical indicators are mixed, and the support and resistance levels suggest that there may be some buying interest at the current price level.

Daily chart of BCE Inc. stock (BCE) from November 28, 2021, to February 8, 2024.

Some Key Observations

Overall Trend

- The chart shows a downtrend in the stock price over the past year. The price peaked at around $65.66 CAD in November 2021 and has since declined to around $53.07 CAD as of February 8, 2024.

- However, the downtrend has been relatively shallow with some periods of consolidation and even price increases. Recently, the price has been volatile, fluctuating between $52.50 CAD and $54.00 CAD.

Technical Indicators

- The 50-day moving average (blue line) and the 200-day moving average (purple line) are both currently sloping downwards, indicating a downtrend.

- The 50-day MA is starting to flatten out, which could be a sign of a potential trend reversal.

- The Relative Strength Index (RSI) (shown below the price chart) is currently around 48, which is considered neutral territory. This suggests that the stock is neither overbought nor oversold.

- The MACD indicator (also below the price chart) is also currently neutral.

Support and Resistance Levels

- Support levels are around $49 CAD and $51.00 CAD. These are price levels where the stock price has found buyers in the past, potentially preventing further declines.

- Resistance levels are around $54.00 CAD and $56.00 CAD. These are price levels where the stock price has faced selling pressure in the past, potentially limiting further gains.

Many online platforms offer trading services, like MetaTrader 5: Download MetaTrader 5 and remember, trading stocks involves risks, so be sure to educate yourself and understand the potential for losses before you start.

Bottom Line on BCE Inc Stock

For CFD traders, BCE Inc. offers a unique blend of income potential and short-term trading opportunities. While not a pure income play, its 7.24% dividend yield adds a cushion and can be factored into trading strategies.

Bullish Bets

- Long-term growth: BCE's network investments indicate potential for future market share gains and stock price appreciation. Strategic acquisitions could further boost growth.

- Dividend play: Reinvesting the generous dividend can compound returns even with modest price movements.

- Technical analysis: Look for chart patterns and indicators suggesting upward trends to enter long positions.

Bearish Plays

- Rogers and Telus pose constant threats, potentially triggering price pullbacks.

- Unfavorable regulatory changes could impact profitability and stock price.

- The current premium valuation might limit significant upward potential.

- Identify shorting opportunities based on downtrends and overbought signals.

BCE Inc. presents a dynamic environment for CFD traders willing to embrace calculated risks and navigate market fluctuations. Weigh the opportunities against the challenges and develop a trading strategy aligned with your risk tolerance and goals for a potentially rewarding experience.