- Education

- About Forex

- Currency Fluctuations

Currency Fluctuations: Trade Forex

It is quite important for traders to have a good understanding of currency volatility. Knowing what causes sudden or frequent fluctuations in exchange rates and what the consequences can be will allow you to plan your business effectively and be future-oriented.

Currency fluctuations occur when there are rapid changes in the exchange rate of a currency pair over a short period of time. Thus, if a currency began to rise and fall in value compared to another, this would be classified as currency pair volatility. Before continue this article you can also read what is Forex trading and how does it work.

Although it is normal for exchange rates to fluctuate when the rate between two currencies fluctuates much more than the average, that is when Forex experts take action.

To empower you to make the best decisions for your business and financial future. We’ve put together this article for everything you need to know about currency fluctuations, so you can apply this knowledge to your business, investments, and more.

Table of Content

- Currency Fluctuation Meaning

- Forex Volatility

- Impact of Exchange Rate Fluctuations

- The Cause and Effect Exchange Rate Fluctuations

- The Most Volatile Currency Pairs

- Currency Pairs are Classified into Several Categories

- Bottom line on Currency Fluctuations

KEY TAKEAWAYS

- Currency fluctuations occur when there are rapid changes in the exchange rate of a currency pair over a short period of time.

- Inflation is one of the most common causes of exchange rate fluctuations.

- The bottom line is that currency fluctuations can be profitable - it depends on what trading strategy you use.

Currency Fluctuation Meaning

Currency fluctuations are constant changes in the relative value of a currency issued by one country compared to another currency. These fluctuations occur every day and constantly affect the relative exchange rate between different currencies. These fluctuations are of interest to traders in currency exchange transactions in order to profit from their investments.

Currency fluctuations can manifest themselves in both upward and downward movement.

When the currencies purchased by an investor show an upward movement compared to the currencies used to make the purchase, there is an opportunity to make a significant profit from the transaction. At the same time, if the exchange rate remains somewhat stable, or if the base currency does increase in relative value, the investor may not make any profit or actually lose money on the trade.

In other words currency fluctuations are a natural consequence of floating exchange rates, which is the norm in most major economies. Exchange rates are influenced by numerous factors, such as the inflation outlook, interest rate differentials, and capital flows.

The exchange rate of a currency is usually determined by the strength or weakness of the underlying economy, and the value of a currency can fluctuate from one moment to the next. Many people don't pay attention to exchange rates because they rarely need it. The daily life of a typical person is conducted in the national currency. The value of the national currency in the foreign exchange market is a key factor for central banks in determining monetary policy.

Directly or indirectly, the level of the currency can play a role in the interest rate you pay on your mortgage, the return on your investment portfolio.

Forex Volatility

Foreign exchange markets are essential for the functioning of the international economy. However, sometimes they seem overly unstable, and sometimes their movements are destructive.

Excessively volatile exchange rates that are not in line with economic fundamentals can lead to real costs to the economy, in turn affecting international trade and investment. And from time to time pressure from foreign exchange markets complicates the definition of monetary policy.

Volatility is a term used to describe price fluctuations relative to an average price over a period of time. Currency volatility, also known as Forex volatility, is the almost constant change in exchange rates in the global foreign exchange market.

The volatility of a particular currency can be considered either high or low. This is measured by how much its value usually deviates from the mean. Simply put, volatility is measured by the standard deviation. If a currency is particularly volatile, that means there is more risk. However, it also means that there are more opportunities to profit from fluctuations if you keep your finger on the pulse and strategize effectively.

Impact of Exchange Rate Fluctuations

So how does volatility affect you and why is it an important factor in decision making in the foreign exchange market? Currency volatility affects most aspects of life.

From the economy to consumers to businesses, most members of society are experiencing shifts to some extent.

While the economy takes the brunt, businesses that operate internationally also carry the weight. All businesses are affected to some degree by currency fluctuations, but those that export or import across borders are the most affected. In these cases, a company's bottom line can suffer greatly if it does not implement a sound risk management strategy.

The Cause and Effect Exchange Rate Fluctuations

Inflation

Inflation is one of the most common causes of exchange rate fluctuations.

- A shortage of things like fuel, labor, or raw materials could cause production to slow down, meaning that consumer prices for goods and services are likely to rise. Inflation also occurs when a high level of buying and demand from consumers allows companies to sell their products at a higher price.

- Inflation can also be caused by changes in the housing market, changes in government policy and taxation, and a number of other factors.

Demand: buying and selling

Forex trading also affects exchange rates.

When a particular currency is in high demand among traders, there is less of that currency left in circulation as traders buy it en masse. So, when forex traders buy a currency at high enough rates, it can influence those hoping to borrow money in that country.

Interest rates on loans and mortgages could rise for local residents due to the appreciation of the currency as a result of trade. Therefore, although the currency itself is stronger in the global forex market, higher exchange rates can also affect the local population.

Political and economic conditions

Political and economic conditions have a significant impact on the exchange rate.

Political unrest is likely to deter foreign investors from buying property or starting a business in a particular region. Which leads to fewer job openings and the local economy will have less room to develop.

Same goes for economic instability; if rising costs of living result in lower disposable income for residents, businesses are unlikely to expand into the region as it would be a risky venture.

Note: the political and economic stability of a country can have a huge impact on exchange rates and, in turn, currency volatility.

The Most Volatile Currency Pairs

First, briefly about what a currency pair is. It's very simple, currency pair consists of two different currencies, the first of which is called the base currency, and the second is the quote currency, and looks like this - USD/EUR. When a trader is executing forex trade orders that means that he buys the base currency and sells the quoted currency at the same time. A sell order would be performed by selling the base currency and buying the quoted currency.

First, briefly about what a currency pair is. It's very simple, currency pair consists of two different currencies, the first of which is called the base currency, and the second is the quote currency, and looks like this - USD/EUR. When a trader is executing forex trade orders that means that he buys the base currency and sells the quoted currency at the same time. A sell order would be performed by selling the base currency and buying the quoted currency.

Currency Pairs are Classified into Several Categories

- Major currency pairs – these contain the US dollar and are commonly the most liquid pairs.

- Minor currency pairs – are pairs which don’t include the US Dollar, otherwise known as cross currency pairs that contain some of the other major currencies such as the EUR, JPY or GBP.

- Exotic currency pairs – these contain one major currency and one from an emerging market.

Currency pairs differ in terms of volatility levels and you can decide to trade highly volatile pairs, or pairs with lower volatility.

What does currency pair volatility show?

The volatility of a currency pair shows price movements during a specific period. Smaller price movements indicate lower volatility, whereas higher or frequent movements mean higher volatility. Simple.

For example:

The price movement of the currency pair is considered in terms of pips, so a currency pair moving 200 pips on average during a given period will be more volatile than a pair moving 20 pips in the same period.

The volatility level can be affected by major economic data releases and political events, as well as liquidity or simply supply and demand of the pair.

Remember that the volatility of a currency pair can change over time as the relevant factors change. For now, these currency pairs are considered some of the most volatile.

- AUD/JPY

- NZD/JPY

- GBP/EUR

- CAD/JPY

- GBP/AUD

- USD/ZAR

- USD/KRW

- USD/BRL

- USD/TRY

- USD/MXN

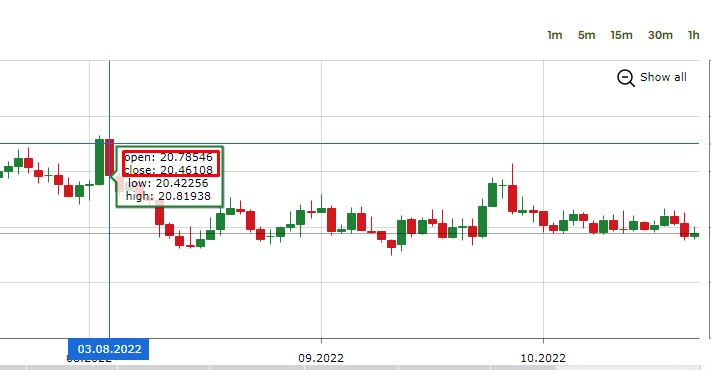

For example, let's check out USDMXN chart and see price movement throughout 2 years, you can see the price movement during the day is quite big.

Bottom line on Currency Fluctuations

Currency fluctuations play an important role in Forex trading.

For example, forex volatility is critical for short-term investors. Day traders, for example, depend on hourly price changes and without hesitation there would be no opportunity for profit.

Volatility is also important for swing traders who work on longer time frames.

Long term traders prefer to follow a buy and hold strategy. The general idea behind long-term trading is that price fluctuations will result in profits over a long period of time.

The bottom line is that currency fluctuations can be profitable - it depends on what trading strategy you use.

FAQs

How does Forex Work?

Forex (Foreign Exchange) is a huge network of currency traders, who sell and buy currencies at determined prices, and this kind of transfer requires converting the currency of one country to another. Forex trading is performed electronically over-the-counter (OTC), which means the FX market is decentralized and all trades are conducted via computer networks.

What is Forex Market?

The Forex market is the largest and most traded market in the world. Its average daily turnover amounted to $6,6 trillion in 2019 ($1.9 trillion in 2004). Forex is based on free currency conversion, which means there is no government interference in exchange operations.

What is Forex Trading?

Forex trading is the process of buying and selling currencies at agreed prices. Most currency conversion operations are carried out for profit.

What is The Best Forex Trading Platform?

IFC Markets offers 3 trading platforms: MetaTrader4, MetaTrader5, NetTradeX. MT 4 Forex trading platform is one of the most downloaded platforms which is available on PC, iOS, Mac OS and Android. It has different indicators necessary for making accurate technical analysis. NetTradeX is another trading platform offered by IFC Markets and designed for CFD and Forex trading. NTTX is known for its user-friendly interface, reliability, valuable tools for technical analysis, distinguished functionality and the opportunity to create Personal Composite Instruments (PCI) which is available specifically on NetTradeX.